Dr. Mark Partridge and PhD candidate Nick Messenger visit our studio to help us understand the nature and burdens of Tax Increment Financing.

We discuss their ongoing 3 year project supporting Franklin County Auditor Michael Stinziano’s Tax Incentive Review Council in attempting to understand the impact of these complex financial mechanisms on our local county services, overall level of taxation and the negative effects created by “competing” municipalities.

Impact of Commercial Tax Incentives in Franklin County

All subsequent images in this piece have been selected from the report publicly accessible at the above link

Partridge and Messenger describe the value brought to their analysis of these tools by the discipline of Regional Science which brings together a variety of interdisciplinary studies to create a complete picture of how TIF’s and other mechanisms like CRA (Community Redevelopment Areas) affect our communities over time and geography.

Nick describes the process of incentive generation and the associated goals of job and tax base growth. He also takes us through the rapid ascent of various forms of abatement post 2008 financial crisis in a local context.

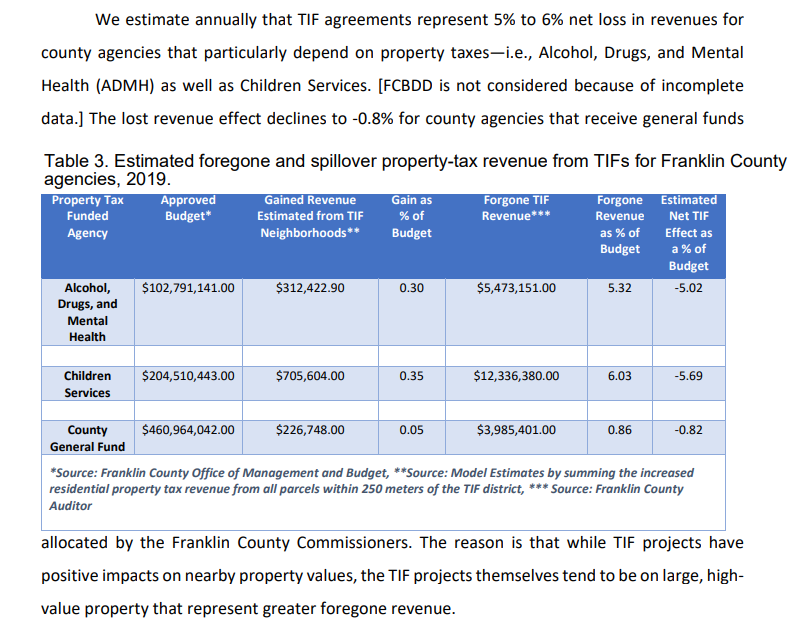

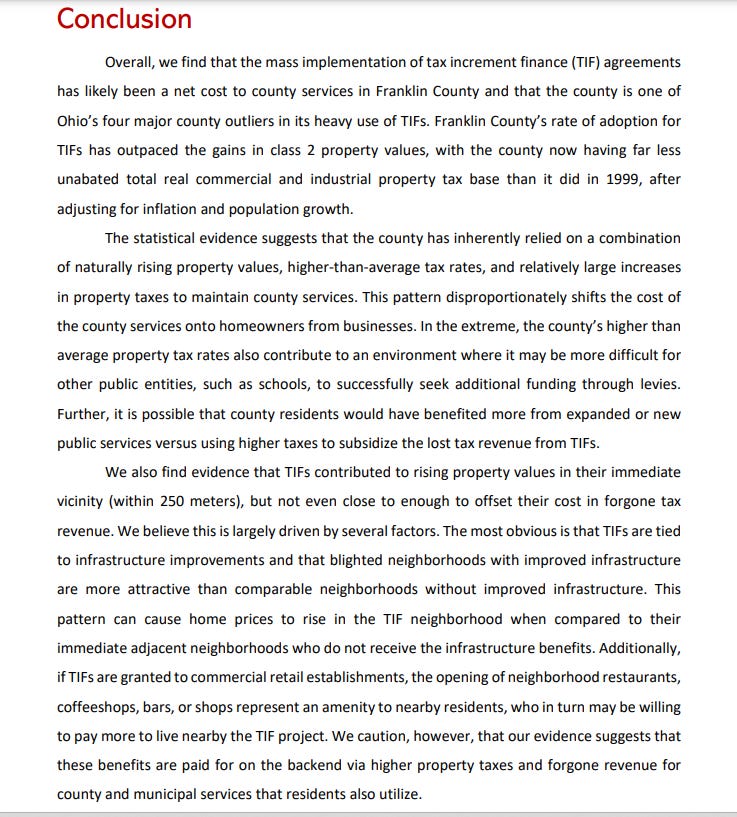

Nick and Mark discuss the losses regularly incurred by county wide agencies and the effects that are generated as a result - including rising property taxes and the recurring nature of foregone revenues year over year through the duration of the TIF.

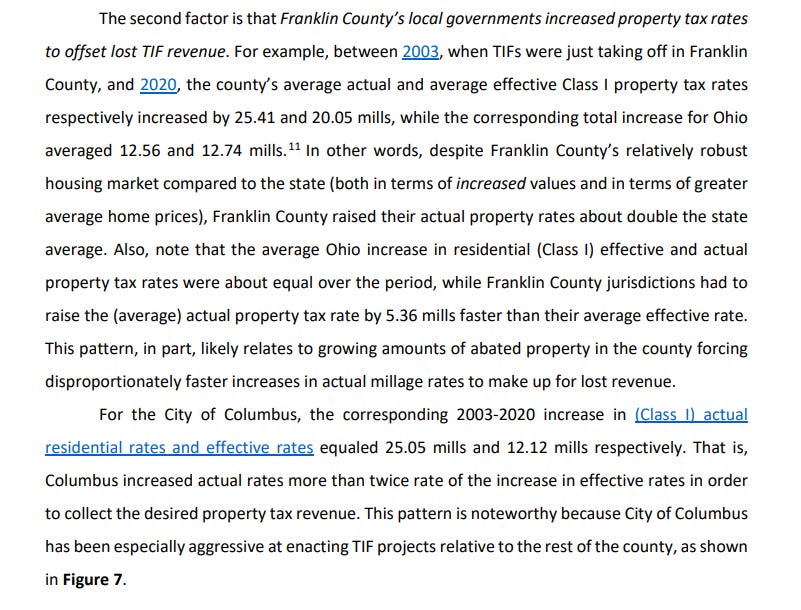

Dr. Partridge describes the means local governing bodies have resorted to in order to mask the shortfalls and spillover effects generated by TIF and CRA decisions. He further works through the disconnect between the theoretical process and benefits of abatement versus the real world “race to the bottom” effects generated and associated fallout.

Jordan fills in some Hilliard history on the hybrid approval sharing system in action and evolving here locally. Nick and Mark describe the gaps in this process and the uncertainty inherent in trying to assess the benefits playing out over such long time frames and with additional, complicating side agreements or variables.

Dr. Partridge describes the shift in burden to individual taxpayers in the form of increased property taxes, income taxes, and slower job growth. Jordan and Dr. Partridge talk through the damage done to a municipal tax base when a full freight taxpayer is recruited from within a county or even within a city to move into a TIF or CRA district.

We conclude the pod by talking about the next installment of Partridge and Messenger’s work underlying the TIRC -which will examine what happens to nearby home values when abatements expire. Can TIF ever be redeemed in any format?

We hope to welcome Mark and Nick back soon to talk specifically about the massive Intel development, the next study in their series, and the future of development in central Ohio and beyond.

Share this post